There’s no sugarcoating it: Funko had a rough first quarter.

The Everett, Washington-based maker of Pop! Vinyl figures and a wide array of toys, collectibles, and lifestyle products under its Funko, Loungefly, and Mondo brands kicked off 2025 on a high note. In January, Funko stock hit a 52-week high of $14.65, bolstered by strong showings at international trade shows, including Spielwarenmesse in Nuremberg and Toy Fair New York.

Momentum was building. The turnaround was taking shape with improved gross profit and margin, reduced expenses, and lower debt in 2024. Like many in the industry, Funko entered 2025 with cautious optimism, hopeful for growth, but issuing conservative guidance that factored in a 20% tariff in line with then-current signals from the White House.

What no one saw coming was a sudden tariff spike to 46% on U.S. imports from Vietnam, and to 145% on U.S. imports from China, paired with inflation and shaky consumer confidence. While reciprocal tariffs on Vietnam slid back to a baseline of 10% amid a 90-day pause that expires July 31, the damage was done.

First-quarter net sales dropped 11%, and adjusted EBITDA fell into the red. Wall Street took notice. Talk of potential loan covenant defaults surfaced, prompting an SEC filing that raised the dreaded question of whether Funko could remain a going concern over the next 12 months. The company’s stock sank below $4 per share — a new 52-week low. With its Q1 earnings release, Funko withdrew its guidance for the year, citing the volatility of tariffs and their impact on the business.

Now, Funko is doubling down: backing The Toy Association’s push for a “Zero for Zero” tariff policy, focusing on mitigation strategies, and leaning into what’s working.

To go deeper than the numbers, The Toy Book sat down with Funko CEO Cynthia Williams and CFO Yves Le Pendeven to talk about resilience, global growth, and the road ahead.

The Toy Book: Tariffs are the topic of the year, with China at the top of the list. On your earnings call, you said that about a third of Funko’s product for the U.S. is currently sourced from China, with a goal to get that under 5% by the end of the year. How will that work?

Cynthia Williams: Today, Pop! figures are made in China and Vietnam, where we have a group of vendors. We also have a highly automated production in Indonesia, and we’re excited to do more there by leveraging our long-term relationships with factory operators.

Our Loungefly products are largely made in Cambodia, with some in China, but we’ve found ourselves in a similar situation as much of the greater toy industry when it comes to production in China. Some Pop! Yourself components are made in China due to some manufacturing skillsets that simply aren’t available outside of China. To an extent, Pop! Figures being unarticulated helped us.

TB: There was a term called out on the earnings call that tends to raise a lot of red flags in this industry: “Going concern.” We’ve seen a lot of companies hit snags and come through just fine, and we’ve seen plenty that haven’t. How are these negotiations going?

Yves Le Pendeven: We’ve gotten covenant relief twice in the past, and it’s the same bank group. In the short term, the product isn’t moving. In the long term, things will pick up in Q3 and Q4, very similar to what happened during the COVID-19 pandemic.

The issue here is from external factors, and Funko did nothing wrong. Banks don’t want to own this company, and I’m very optimistic that it will be like COVID, and we’ll agree on things and move on.

TB: Amid all of this, Funko had another round of layoffs, with some folks let go and other open positions left unfilled…

CW: Having to do a reduction at this time was really, really tough. It was a rough week. We’ve stayed laser-focused on what our fans care about and cut SKUs that don’t resonate with them. The majority of affected positions were related to those projects.

TB: At the same time, there has been some discussion of upping the value proposition and creating Pop! figures with elevated sculpts and packaging. How will Funko do more with a smaller team?

CW: We have an incredibly hardworking team that can’t take on more work. We’re getting rid of things like repeat stances [repaints], which our fans have made clear they don’t like. We’re on fire with anime, and if you look at some of the recent releases there, you can see newer sculpts that fans love.

With packaging, core collectors wanted real scarcity. We just did our first Limited Edition Legendary drop — Pop! Genya Shinazugawa from Demon Slayer. It’s limited to 1,200 pieces and was sold out in 30 minutes.

TB: The new Limited Edition tiers — Grail, Legendary, Royalty, and Elite — are a direct-to-consumer play, so how can traditional retailers benefit from this?

CW: At retail, we’ll do limited runs of 9,000 pieces at the high end. Some of the bigger specialty stores like Hot Topic and Box Lunch, and mass partners like Target, will take runs of more than 3,500 pieces.

TB: When tariffs on Vietnam dropped back to 10%, what was Funko’s first move?

CW: We worked closely with all of our partners to get stuff on the water quickly and to plan appropriately.

TB: On the eve of Licensing Expo, I imagine this environment has created challenges on that side of the business, perhaps with renegotiated deals.

CW: Navigating licensing has created new questions, many of which come from the licensor, who asks, “Will we have products?” We’re fortunate that our product coming out of Vietnam can help keep retailers stocked, and we can do that quickly. If someone else’s licensed product isn’t going to make it, we might be able to fill the gap.

TB: That is a silver lining that few manufacturers have right now. Despite all the challenges, Funko has seen some wins so far this year, so let’s talk about what’s working, like sports and music.

CW: Yes! We planned and prepared for [Washington Capitals Captain] Alexander Ovechkin to break Wayne Gretzky’s record with his 895th career goal. We sold more than 15,000 units across all channels.

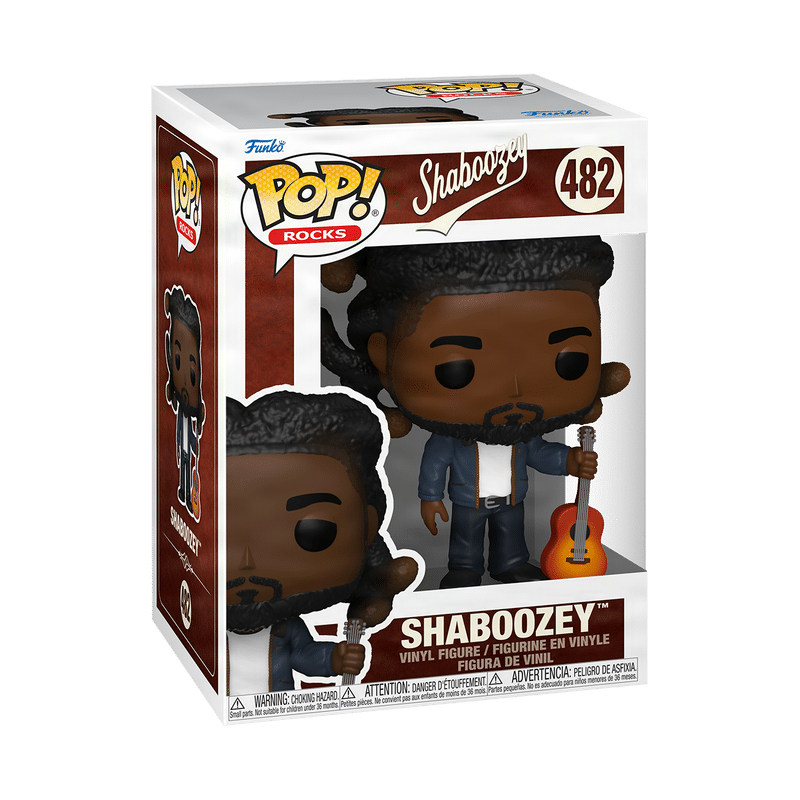

We’re looking to connect with fans in culturally relevant moments, and we did that again with Sabrina Carpenter at the Grammys and Shaboozey’s appearance at Coachella.

Gaming is another area of growth — not surprising, but it’s growing. Dungeons & Dragons, Astrobot — we love those moments. And we’re very excited for our new collaboration with the WNBA.

TB: You’ve been working toward “a more global Funko” — how hot is the international market right now?

CW: Our international sales in the G5 markets are outpacing the rest of the toy industry, so it’s a very healthy business. We’re gaining share in Europe, the UAW, and China. And the Philippines is our strongest market in Asia. Our new licensed store will open there next month.

Despite the headwinds, Williams remains energized by her team’s focus and commitment to the Funko fandom. With operations tightening and tariffs temporarily eased — 30% (10% baseline + 20% fentanyl tax) for imports into the U.S. from China, down from the staggering 145% earlier this month — the company is embracing the moment, not just to recover but to innovate.

The road ahead winds through some major milestones: Funko Fundays lights up Hollywood next month with three days of unforgettable experiences and exclusive drops, followed by a return to Comic-Con International: San Diego (SDCC) in July. But first, it’s all eyes on Las Vegas, where the team is ready to make big moves at Licensing Expo this week — sealing the deals that will shape the next generation of pop culture products.

Trending Products